Customer Churn and How You Can Reduce It

With an abundance of choice and competitive offerings, customers these days don’t need much of a reason to jump ship. Losing customers is known as customer churn. Churn is both costly and can stunt your organization’s growth. Simply put, too much churn is bad for business.

Customer retention, the opposite of churn, is great for business. It’s directly linked to profitability. Research has shown that when retention rates are increased by 5%, profits increase anywhere from 25% to 95%.

Unfortunately, humans are fickle creatures. Couple that with a myriad of viable alternatives and you'll find that churn is relatively common. The question, then, is how can you reduce your customer churn?

Thinking carefully about your customer experience and listening to what your customers are two great places to start, but there is much more you can do.

Here we’ll take you through how to calculate your customer churn rate and why it’s important to do so. We'll also touch on measures you can take to reduce your churn rate.

You can jump ahead to the section you’re most interested in here:

- What is Customer Churn?

- How To Calculate Customer Churn

- The Importance of Customer Churn

- How to Reduce Customer Churn

- Conclusion

What Is Customer Churn?

Customer churn is the percentage of customers that a company loses in a determined time period.

There are many different reasons that a customer might stop doing business with a brand. It might be because the product or service didn't satisfy their needs, that they received bad customer service, or that the price was better somewhere else… the list goes on.

Churn exists across all industries - from fast food to fashion retail and everything in between. However, it is easiest to measure in subscription-based companies as customers need to cancel which marks a clear end to the relationship.

But no matter your industry, churn rate can and should be calculated.

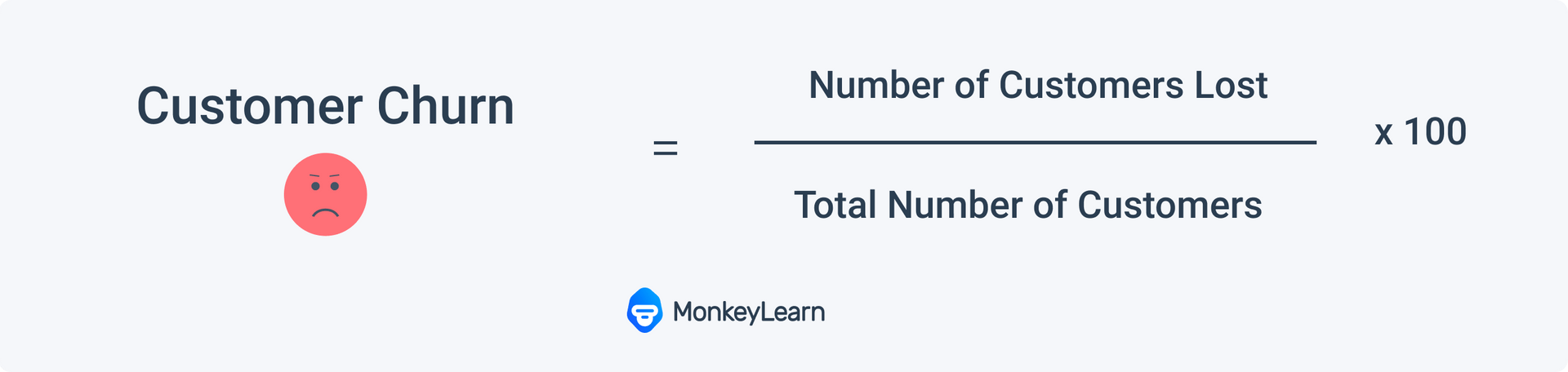

How To Calculate Customer Churn

Customer churn is calculated by dividing the number of customers you’ve lost by your total number of customers and then multiplying it by 100.

For example, if you had 20 customers at the beginning of a quarter and you lost 2 over the following three months, this would give you a churn rate of 10% for that quarter.

What Is a Good Churn Rate?

The next logical question is what exactly should your churn rate look like, and when can you assume you have a problem. Some churn is normal: 5-7% is generally seen as an acceptable annual rate. Less is obviously better.

An example of an acceptable churn rate can be found with Netflix who reported a monthly churn rate of 2.4% at the end of Q1 of 2021.

This benchmark will vary according to industry, size of organization and even customer segments. Within financial services, for example, churn rates tend to be a lot higher.

The fact of the matter is that, while churn is inevitable, it’s not desirable to lose any business. Therefore doing everything you can do to reduce churn is essential.

The Importance of Customer Churn

Tracking and keeping your churn rate under control is critical for sustained business. Even though it's natural to lose some customers, studies show that retaining existing customers is far more cost-effective than finding new ones. This is because acquiring a new customer can cost up to five times more than retaining an existing one. Added to that, U.S. companies actually lose an estimated $136.8 billion a year due to consumer switching.

So, while your marketing campaigns to attract new customers might be successful, if you can't hold on to your existing customers, your bottom line will take a hit.

Also, your churn rate, and its changes over time, can tell you when you’re doing something wrong, and when you’re doing something right.

If you’re not keeping track of customer churn periodically, you can’t employ preventative measures to fix issues that arise. You also won't be able to track the effectiveness of improvements you’ve made to your customer experience.

Now that we know what customer churn is and why it is important, let’s take a look at how you can improve it.

How to Reduce Customer Churn

There are a number of steps you can take to improve your churn rate. Your starting point is listening to your customer, but there’s more to it than that.

- Measure customer satisfaction

- Analyze customer feedback

- Close the feedback loop

- Focus on your loyal customers

1. Measure Customer Satisfaction

To understand what potential pain points your customers are facing, you need to ask them. The most popular and effective way to do this is with customer experience surveys.

Surveys can be deployed at particular touchpoints within your customer journey to give you insights that are specific and actionable. For example, you can deploy a customer satisfaction survey when a customer chooses to cancel a service to decipher exactly what it was that drove them away.

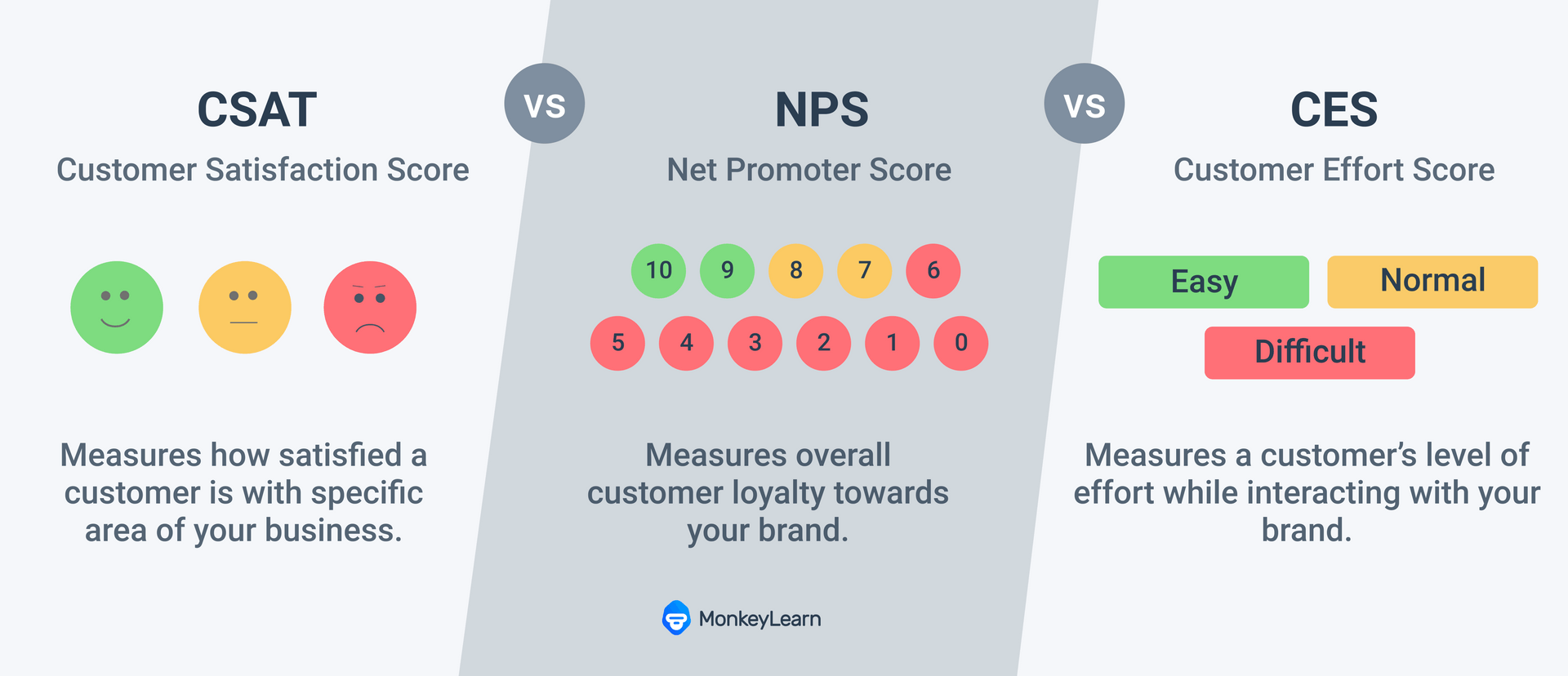

There are three key survey metrics. They all achieve slightly different things and are most powerful when used in combination with each other. Let’s take a look:

Net Promoter Score (NPS)

The Net Promoter Score focuses on your customers loyalty as a whole by specifically asking how likely they are to recommend your services to a friend or acquaintance.

Customer Satisfaction Score (CSAT)

As the name would suggest, the Customer Satisfaction Score survey asks your customers to rate their satisfaction levels with specific touchpoints they encounter along the customer experience journey.

Customer Effort Score (CES)

The Customer Effort Score metric shows how much effort your customers feel they have to put into interacting with your organization. This is important to keep track of, seeing as effort level closely correlates with loyalty.

2. Analyze Customer Feedback

When you get your survey results back, the next thing you’ll need to do is analyze them for customer insights.

Your survey responses are most likely rich with information about how your customers really feel about your products and/or services. This is vital information that can help you retain customers. Without the proper analysis practices, however, it is easy to lose out on this.

To gain actionable insights, you’ll need to sort through and process this qualitative data. How? The best way is to use machine learning combined with natural language processing, to automatically analyze your data. Manual processing is not a great option due to it being inefficient, slow, and sometimes impossible due to the sheer amount of information.

Machine learning, on the other hand, is scalable, fast, and accurate. MonkeyLearn offers a suite of no-code machine learning tools to analyze unstructured customer data.

For example, this survey analyzer tags your customer responses by topic:

Combine this with sentiment analysis (which detects if opinions are positive, negative, or neutral) and you gain exact insights into which aspects of your business customers are happy or disappointed with.

In this example, you can quickly detect that the customer is complaining about your customer support. Because of this, you might consider offering customer support after working hours to retain more customers.

These tools allow you to extract insights in a fraction of the time that it would take you to do so manually. Better yet, they offer all of this in real-time so you can act quickly when you detect any issues.

For more detailed information about how to analyze customer churn, check out this post.

3. Close the Feedback Loop

Once you have asked your customers questions and analyzed their feedback you need to act on that feedback to effectively close the feedback loop. Then tell them that you listened and keep them in the loop with regards to changes or new products.

When you contact them, taking a personalized approach is best. Segment your customers in groups so that you can target them with appropriate communications. This will make them feel like you are tailoring their experience.

Keeping in touch with your customers could make the difference between them staying with you or abandoning your company.

4. Focus On Your Loyal Customers

Finally, an important starting point when looking at customer churn is the customers that are sticking around — your most loyal customers. Seeing as they are already enjoying your offerings, it makes sense that they might like to buy more from you.

This is also backed up by studies, which have shown that existing customers are 60 – 70% more likely to buy your products, while the probability with new prospects is only 5-20%.

Your loyal customers are an opportunity sitting right in front of you. Sell to your existing customers and ask them to refer you to their contacts. Then go beyond that and reward them for their loyalty and ask them what they expect from you. You will then see increased overall brand loyalty (and the sales that come with it).

Conclusion

Customer churn can have a huge impact on your potential profits. While it may be to some degree inevitable, your actions and the preventative measures you put in place can go a long way to reducing that churn.

Listening to your customers is fundamental if you want to keep them happy and retain them. Analyzing what they are saying is also crucial. In order to analyze your data effectively, you need the right tools at hand.

Here’s where MonkeyLearn can help. To get started, sign up for a demo today to see how our tools can help you reduce your customer churn.

Rachel Wolff

September 7th, 2021